Who Is a Charitable Lead Trust For?

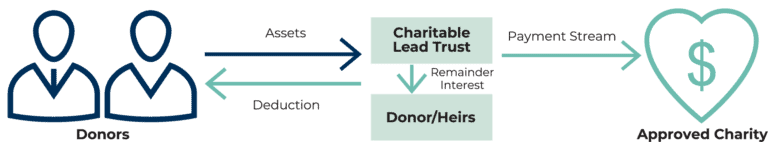

A charitable lead trust is a powerful charitable planning tool that provides the grantor tax benefits for income, gifts, and/or estate transfers. It also provides charitable organizations with an income stream throughout the trust term. Charitable lead trusts are used by individuals who desire an income tax deduction to offset current year taxable income or who desire to reduce or eliminate federal estate and gift taxes from transferring their wealth to heirs.

Unlike charitable remainder trusts, charitable lead trusts are not tax-exempt, and therefore annual trust income is either taxed to the grantor (for grantor lead trusts) or to the trust (for non-grantor lead trusts.

Our charitable lead trust questionnaire can help you determine if a charitable lead trust is appropriate for you. Click the button below to fill out the questionnaire, or keep reading for more

helpful information.